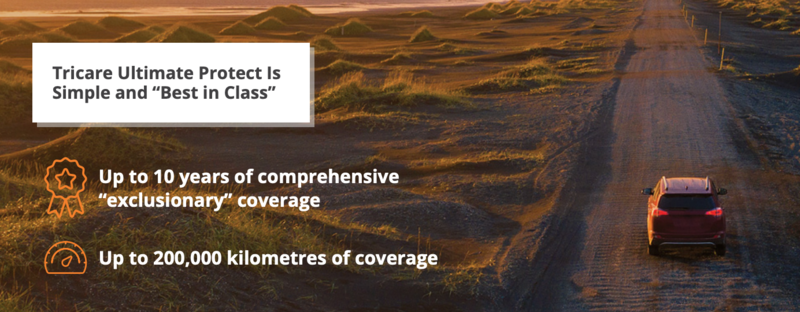

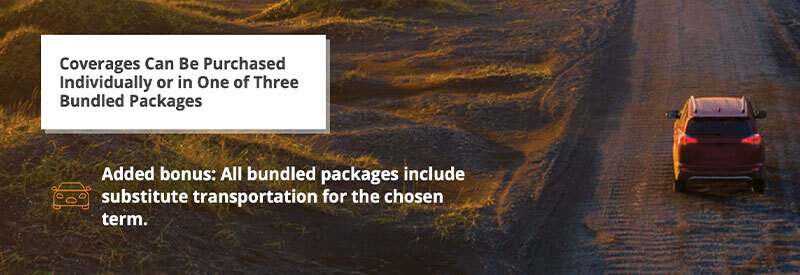

Protects you from the rising cost of mechanical and electronic repairs to your vehicle. Tricare Ultimate Protect ensures worry-free ownership for years and kilometres to come and shields you from the cost of unexpected repairs beyond the manufacturer’s original warranty. Added benefits include roadside assistance, substitute transportation allowance and a fast, efficient claims process.

Protection From Unexpected Repairs

It’s comforting to know that having this coverage will protect you from inflation and the ever-rising cost of mechanical or electronic repairs. Tricare Ultimate Protect allows you to enjoy your vehicle worry-free for years and kilometres to come. The average Canadian driver will own their car well beyond the expiry of the manufacturer’s limited warranty coverage. Today’s vehicles are loaded with sophisticated mechanical, electronic and computer systems. When any of these systems fail, the cost of repairs is always unexpected and most people do not budget for these large expenses.

Emergency Roadside Assistance Services Include:

Towing, Jump-Starts, Lockouts, Flat Tire Changes, Fluid Delivery Assistance and Concierge Service. Our highly trained team is at your disposal 24/7, 365 days a year.

- Towing - Towing services will be provided to you as part of our Emergency Roadside Assistance Program. We will pay up to $250 to tow your vehicle back to your selling dealership.

- Trip Interruption Coverage - In the event of a breakdown occurring over 160 kilometres from home, and covered by the contract, we will reimburse you for up to $125 per day toward food and lodging if the vehicle must remain overnight in the repair facility, up to a maximum of 3 days.

- Transportation Allowance - We will reimburse you up to $40 per day for almost any kind of substitute transportation from the date of the covered breakdown to the date the repair is completed.

- Immediate Credit Card Payment - We make a credit card payment to the repair facility less any deductible for the covered repairs so that you are not out of pocket and there is no waiting period for reimbursement.

- Easily Transferable - If the vehicle is sold privately during the term of the contract, the remaining Tricare Ultimate Protect coverage may be transferred to the new owner.

- Customer Loyalty Program - At trade-in time, you may be eligible to redeem the unused portion of your policy and apply it towards the purchase of a new Tricare contract on your next vehicle.

- North America—Wide Service - All Tricare plans are covered across Canada and the continental United States.

Tire & Rim Protection

Coverage for the repair of flat tire(s) and/or damaged rims (or, where repair is not possible, replacement) due to a Road Hazard. You are also covered for the costs of mounting, balancing and all applicable taxes.Bonus Coverage: Includes Trip Interruption Benefit

Tire & Rim Protection with Cosmetic Wheel Repair

Coverage for the repair of flat tire(s) and/or damaged rims (or, where repair is not possible, replacement) due to a Road Hazard. Includes Cosmetic Wheel damage caused by a Road Hazard or by contact with curbs or fixed items on the roadway.Bonus Coverage: Includes Trip Interruption Benefit

KEY & REMOTE REPLACEMENT

Coverage for the replacement of your Key/Remote if it is accidentally lost, stolen, or destroyed. Bonus Coverage: Includes Trip Interruption Benefit

TIRE & WHEEL PROTECTION

Flat tires are the most common cause of vehicle breakdown. Coverage is provided for flat tires and damaged rims due to a road hazard.

Paintless Dent Repair (PDR)

Coverage for the repair of minor dings and/or dents on the outer body panels of the vehicle provided the ding or dent is repairable under the PDR process. Bonus Coverage: Includes a one-time claim up to $500.00 towards your insurance deductible for Hail/Acorn damage.

Paint Repair

Coverage to repair an exterior painted body panel that is accidentally scratched and the scratch is greater than 2 inches in diameter.

Available only in Level I, II and Commercial

Windshield Repair*

Coverage for reasonable costs to repair minor stone chips or cracks up to 6 inches in length due to Road Hazard damage to the front windshield. This service will not pay for windshield replacement.

Available only in Level I and II

Headlight/Tail Light/Fog Light Protection

Coverage for headlights, fog lights and tail lights that are damaged as a result of a Road Hazard. Bonus Coverage: If a lens fades or yellows, it will be reconditioned to a maximum benefit allowance of up to $100.

Available only in Level II

Rips,Tears & Burns

Coverage to repair the damaged area if a seat accidentally rips, tears or burns.

Spot Removal

Coverage for the cleaning of a seat that becomes accidentally soiled.

Available only in Level II

Windshield Repair/Replace*

Coverage for the repair of minor stone chips or cracks due to Road Hazard damage to the front windshield. If the damage is not repairable, a one-time claim up to $1000 can be paid to replace the windshield or towards your Insurance deductible.

Available only in Level II

CAR RENTAL REIMBURSEMENT

Keep moving, even when your car can’t. If your vehicle remains in the Dealership or Repair Facility for greater than one day as a result of your covered Tricare Plus repair, you will be reimbursed up to $40 per occurrence.

* Ask your dealer for more details regarding qualifications, conditions, requirements and pre-owned vehicle coverage.

*Windshield Repair and Windshield Replacement are not available in AB, SK, MB, YT, NT or NU

Offers unrivaled protection against many common environmental hazards such as UV rays and corrosion that cause damage to your vehicle.

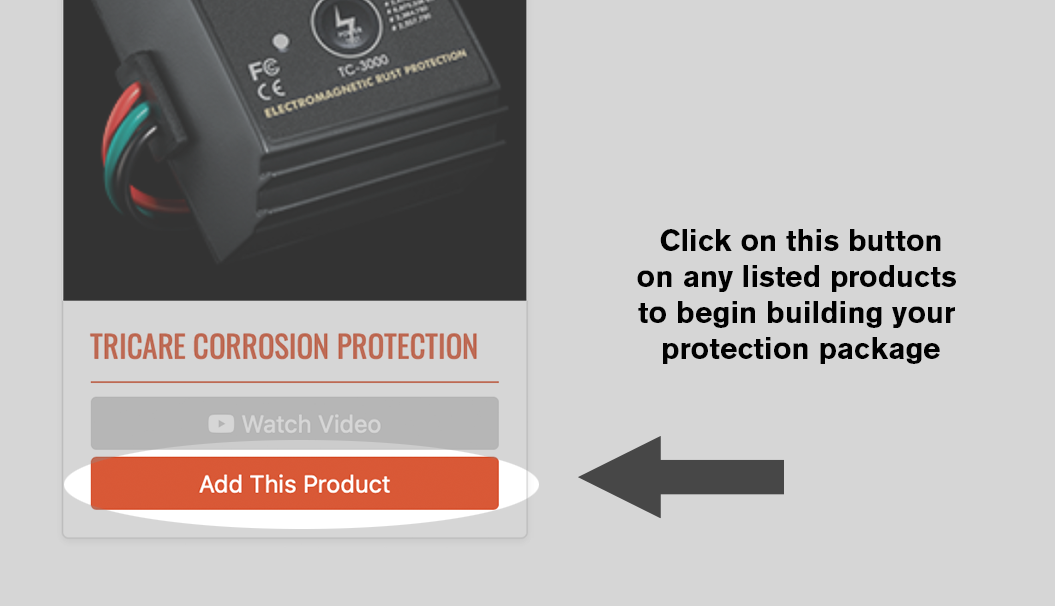

Electromagnetic Rust Inhibitor Module

Fighting rust is a must! Take advantage of an effective and eco-friendly method to protect the body of your vehicle from the damaging effects of corrosion.

Despite advances in auto manufacturing, you need corrosion protection that goes beyond the manufacturer’s limited rust warranty. Our environmentally friendly Electromagnetic Rust Inhibitor module offers the most advanced corrosion protection available and works on all vehicles, including hybrid and electric models.

ONLY OUR PATENTED TECHNOLOGY OFFERS:

- Testing that has proven to reduce the rate of corrosion on automotive sheet metal panels by up to 99.7%.

- The only automotive corrosion technology to be published in a highly reputable science journal.

- A comprehensive warranty that extends well beyond what the manufacturer offers.

- A patented pulse-wave signal that is harmless to you and your vehicle.

- The most environmentally friendly corrosion solution available today.

- Protection against areas rust chemical spray could never protect.

- Total corrosion perforation (hole) protection.

ONLY OUR PATENTED TECHNOLOGY OFFERS:

- Canadian #3,118,018

- Canadian #2,558,790

- US #7,198,706 C1

- US #11,598,010 B2

- Taiwan #I 359210

- China #ZL 200510069527.0

- Hong Kong #HK 1084982

- Australian - AU #10/846,598v

- European - EP Patent No. 1598445

Warranties vary, ask your selling dealer for specific warranty coverages.

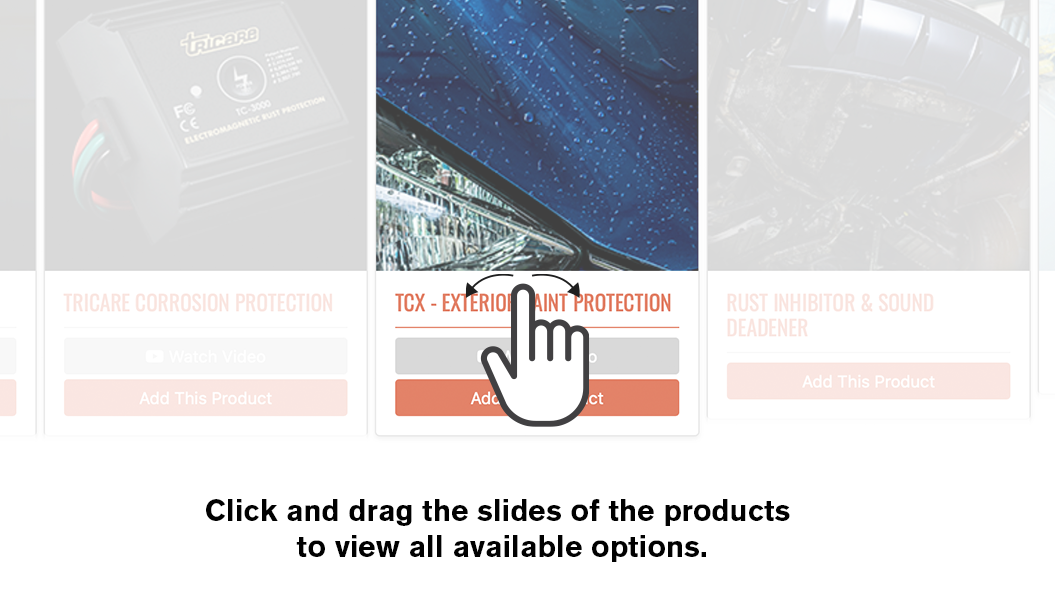

Tricare TCX Paint Protection

Our advanced Carbon Polymeric Paint Coating offers the best exterior paint protection available in the industry. Tricare TCX is an eco-friendly exterior paint treatment free from volatile organic compounds (VOCs) and specifically formulated to bond directly to your vehicle’s clear-coat finish.

Professionally applied by trained technicians, this protection provides a lasting protective barrier and creates a smooth, easy-to-clean surface that resists adhesion and protects against the damaging effects of ultraviolet (UV) rays.

Tricare CeramX Paint Protection

Tricare CeramX is the next evolution in maintaining any vehicle’s paint finish. Our specialized Silicon Carbide Ceramic Coating was engineered by the same scientist that brought clear-coat technology to automotive paint. As such, our formulation has been specifically designed to activate with the clearcoat of any vehicle, forming a more hydrophobic durable extension of its paint instead of residing on top as many other silicon dioxide ceramic and polymer products do.

Both Tricare TCX and Tricare CeramX protect against permanent paint damage from:

- Tree sap

- Bird droppings

- Insects

- Road tar

- Acid rain

- Industrial fallout

- Oxidation and loss of gloss

A one-time, permanent treatment for interior surfaces of the vehicle, including seats, armrests, headrests, carpets, dashboards and door panels.

The special formula works equally well on both leather and fabric and does not change the natural feel or look of your interior. It provides a powerful and invisible barrier that remains effective even after numerous spills.

The treatment protects your vehicle’s interior against permanent stains from food, beverages, oil, grease, urine or similar liquids. As an added bonus, it includes coverage for accidental rips, tears and burns on seats, headrests, interior cloth, carpets and the dashboard.

The Tricare Cosmetic Rust Warranty is automatically applied with the purchase and application of both the Electromagnetic Corrosion Protection Module (TC-4000 or BHP-5000) and TCX Paint Protection.

What our warranty includes:

2-part warranty: The first part of the warranty is defined as a paint bubble on the painted outer-body sheet metal panel where no rust and/or bare metal is showing and the paint is not broken, cracked, split, chipped, peeled, delaminated, flaked, worn off or missing around or leading up to the paint bubble.

The second part of this warranty coverage is defined as surface rust damage where the paint is missing, and the surface rust area is at least two centimeters in diameter or larger. The covered areas of your vehicle are the outer-body sheet metal panels — ones that are finish-painted and that someone can see when walking around the vehicle. These areas are the roof, rear quarter panels and front fenders. The doors, engine hood, trunk lid and tailgate are also covered for paint bubbling and cosmetic rust damage that is visible from the exterior of the vehicle, when these panels are in their closed position.

Provides a monetary benefit towards the purchase of a replacement vehicle if your vehicle is stolen and not recovered.

Protect Your Vehicle From Theft

The Insurance Bureau of Canada (IBC) theft analysts suspect that many vehicles are targeted as part of a trade-based money-laundering scheme. The 20% recovery rate of stolen vehicles indicates the involvement of organized crime rings who commit auto thefts, and use the proceeds to fund criminal activities.

Thieves generally steal vehicles for one of three reasons:

- To sell abroad: Stolen vehicles are often shipped abroad, where they are sold for many times their original market value.

- To sell to unsuspecting consumers: Stolen vehicles may be given a false vehicle identification number (VIN) and then sold to unsuspecting consumers. These vehicles can also be dismantled and sold for parts.

- To commit another crime: Stolen vehicles used to commit other crimes are often recovered—abandoned and badly damaged—within 48 hours of their theft.

Thieves Avoid Vehicles That Are Traceable

Replacing the etched components of the vehicle is too time-consuming and too expensive to be profitable.

BUT if your vehicle is stolen

- A Benefit of $3,500 This benefit is paid should your vehicle be stolen and not recovered in 30 days, or if the vehicle is recovered but is damaged to the extent it is determined to be a total loss.

- 5% Discount In the event your vehicle is stolen and recovered in a damaged condition but is not a total loss, you will be entitled to a 5% discount (maximum value of $500) on vandalism repairs at your issuing Tricor dealership.

- Reimbursed for Actual Expenses If you are travelling more than 150 kilometres from your home and your vehicle is stolen, you will be reimbursed for actual receipted expenses as follows, provided a replacement vehicle is acquired:- $30 per day for substitute transportation for a maximum of 20 days- $80 per day for room and board for a maximum of 5 days

- Airfare If your vehicle is stolen more than 750 kilometres from your home, you will be entitled to reimbursement for a one-way airfare ticket (maximum value of $600).

What Is the Best Way to Pay for a Vehicle?

It is very likely that financing will be required when purchasing a vehicle, as few people have the ready cash available to pay for their new car or truck. Buying a new or used vehicle is one of the largest and most significant financial decisions you will make, therefore it is important to choose the right financing option to best suit your personal needs.

Learn more here and on the tabs to the right about your various payment options.

There are two main types of vehicle financing: Purchase and Lease financing. Either choice will likely have a cost attached because of associated interest charges. However, taking advantage of low-interest vehicle financing incentives available from the manufacturer allows the flexibility to use your money more productively.

The Application and Approval Process

The application and approval process is the same for both Personal and Auto loans and leases:The lender requires a complete credit application to support the credit request, along with other documents such as proof of income.In the case of a Personal loan, if the request is approved, funds can be quickly transferred to your account.

Amount to Finance

The amount that the financial institution will approve will determine the cost of vehicle that can be purchased or leased. Approval depends on a number of factors including the applicant’s:

- Income

- Credit history

- Credit score

- Current debt load

- Amount of money as a down payment

Financial institutions usually decline financing because the credit rating of the applicant is not strong enough. Many dealerships have financing experts who specialize in obtaining credit for buyers with weak or nonexistent credit, or with credit challenges.

The majority of vehicles purchased in Canada are financed with loans. The total cost of the vehicle is financed over the term of the loan, at which time the buyer owns the vehicle after the last payment is made.

Personal Versus Vehicle Loan

The most common method of purchasing a vehicle is by borrowing the money and repaying it in set monthly installments. This can be done either by taking out a Personal loan or a Vehicle loan. Most Personal loans are unsecured, meaning there is no collateral for the money being borrowing and the funds can be used for any purpose.

A Vehicle loan differs from a Personal loan because the money can only be used to purchase a vehicle. A secured loan means the vehicle serves as collateral against the loan. With security backing the loan application, there is usually a higher chance of approval and lower interest rates compared with an unsecured personal loan.

The Benefits of a Vehicle Loan

- Lower interest rates (compared to an unsecured personal loan) with terms up to 84 months or longer

- Reduced interest rates offered as manufacturer incentives for both New and Certified Pre-owned vehicles

- Fixed interest rates and will not vary during the term of the loan

- Open loans and can be paid off at any time without penalty

In Canada, leasing accounts for nearly a third of new vehicle sales. Pre-owned vehicles may be eligible for leasing as well. In a lease, the amount financed is based upon the initial cost of the vehicle and the Residual Value (RV). The RV is the amount the vehicle will be worth at the end of the term of the lease, based on an estimate of the lessor (the owner).

Types of Leases

When considering leasing a vehicle, it is important to determine what type of lease is most appropriate. There are two main types of leases: closed-end and open-end.

Closed-end Lease In a closed-end lease, the lessor of the vehicle is responsible for the RV of the vehicle, and the lessee has the option of either returning the vehicle at the end of the lease or buying it back from the lessor at the RV specified in the lease contract. New vehicle manufacturer leases are closed-end. At the end of the lease, if the option to buy the vehicle at the specified RV is not exercised, the lessee is responsible for paying for any damages that go beyond normal wear and tear and/or excess mileage charges that cause the vehicle to be worth less than the specified RV. Most closed-end leases also have a maximum mileage limit for the term, usually based upon annual mileage of between 16,000–24,000 kilometres. If this limit is exceeded, a specified per kilometre overage fee is charged at the end of the lease term.

Open-end Lease An open-end lease allows the lessee to guarantee the value of the vehicle at the end of the lease. This is called the Guaranteed Residual Value (GRV) and is specified in the lease contract. The lessee has the option of purchasing, selling or trading in the leased vehicle at the end of the contract for the GRV, provided the vehicle is worth at least that amount. If the market value of the vehicle is less than the GRV at the end of the lease, the lessee is responsible for the difference if they wish to return it to the lessor. For example, if the GRV is $16,000 and the market value for the vehicle is only $14,000 at the end of the contract, the lessee will be responsible for paying the difference of $2,000. Open-end leases are more common in business and commercial leasing. The person or company leasing the vehicle takes on the RV risk, and leasing terms may be more flexible.

The Benefits of Leasing

- New vehicle ownership every 2 to 4 years

- Shorter-team leases mean vehicle often still covered by OEM warranty

- Drive a more expensive model than anticipated

- Closed-end leases can protect you from risk of negative equity at lease end

The Benefits of Financing Through a Dealership

- Convenient, "on the spot" finance solution and expert advice

- Dealership finance specialists can negotiate the best terms and conditions on your behalf

- Access to Incentivized Finance Rates from the manufacturer

- Access to most or all of the major banks and other lenders

- Access to lenders that specialize in assisting credit-challenged buyers

- Fast approval and funding

Cash from Lines of Credit

Industry statistics show the majority of vehicles sold are financed by a loan or a lease. Bank studies indicate only a very small percentage of vehicle purchasers are true cash buyers. This is not surprising as Statistics Canada reports that the cash savings for the average Canadian family in 2018 was only $852.

However, there are 5 good reasons not to use a LOC to finance a vehicle:

- Although there are many types of LOCs, most are are secured by home equity LOC (HELOC).

- The LOC is a demand note, i.e., the financial institution can demand repayment of the full amount owing at any time.

- The interest rates are variable and can be raised at any time by the financial institution.

- The financial institution can raise or lower the credit limit on an HELOC.

- LOCs are designed as an interest-only loan.

The last point is very important. Financial institutions are in the business of lending money and collecting interest on those loans. An LOC is a revolving form of credit usually allowing interest-only payments to be made on the outstanding balance. Unfortunately, if a set monthly payment towards the outstanding balance is not made, it is possible that the loan will never be paid off, resulting in higher overall interest charges than a conventional loan, despite the lower interest rate of the LOC.

An IPSOS study of Canadian consumers conducted in 2018 revealed that 25 percent of respondents said they only made the interest payments month to month and that most consumers do not repay their HELOC in full until they sell their home. Financing with an LOC may result in a balance still owing when it comes time to sell or trade the vehicle.

In short, using an LOC to purchase a vehicle is not a wise financial decision.

Cash from Savings Instruments

Guaranteed Investment Certificates (GIC), Tax Free Saving Account (TFSA), Registered Retirement Savings Plans (RRSP).

Withdrawing money from a GIC, a TFSA, or an RRSP also allows the cash purchase of a new vehicle. Unfortunately, withdrawing those savings could result in negative tax consequences, i.e., paying income tax on the amount withdrawn. In most cases, leaving money invested is a wiser financial move as it continues to earn interest and appreciate as originally intended.

Provides an innovative and cost-effective way to ensure your credit stays protected if an unexpected life event occurs.

Protect Your Credit and Financial Well-being From Unexpected Life Events

Tricare Debt Protect offers cost-effective Life, Critical Illness, Disability and/or Accidental Plus insurance, each with unique coverage options.

Depending on the Tricare Debt Protect coverage that you choose, you may have the option to either:

- Keep your vehicle, with your payments being made for up to 12 months and up to the stated policy amount.

- Return the vehicle and the balance shortfall will be paid to the stated policy amount.

- The balance shortfall means the difference between the amount owing to the financial institution under your finance contract and the vehicle’s value.

Life Insurance Coverage

This benefit will allow for the return of the vehicle to the dealership and the balance shortfall paid to the maximum benefit amount, in the event of death.

Critical Illness Coverage

This benefit allows for the return of the vehicle to the dealership and the balance shortfall paid to the maximum benefit amount, in the event you are diagnosed with a covered critical illness.

Disability Insurance Coverage

This benefit will make your monthly vehicle payments for up to 12 months and up to the stated policy amount if you become totally disabled due to injury or sickness. If and when the monthly benefit is exhausted, you have the option to return the vehicle to the dealership and the balance shortfall will be paid to the maximum benefit amount.

Disability and Loss of Employment Insurance Benefit (Accidental Plus)

Accidental “Plus” Insurance includes both Disability insurance, if you become totally disabled solely due to an injury, and Loss of Employment Insurance. This policy will cover your monthly payments for up to 12 months and up to the maximum benefit amount.

If and when the monthly benefit is exhausted, you have the option to return the vehicle to the dealership and the balance shortfall will be paid in full to the maximum benefit amount.

- Of all loans that become delinquent in Canada, 3% are due to the unexpected death of the main household income earner, and 50% are due to loss of income relating to a disabling accident or illness.

- Canadians between the ages of 20 and 65 have a 50% chance of having a disability that lasts longer than 3 months.

- Canadians aged 35 to 54 are hardest hit by unforeseen healthcare costs.

- 76% of working Canadians state serious financial effect for their family if disability keeps them out of work for 3 months.

Tricare Debt Protect provides you with peace of mind knowing that the coverage you select will protect you from financial hardship and the negative effects on your credit if you are unable to make your loan payments due to an unexpected life event.

Please ask your Tricor dealer for full program and contract details regarding qualifications, conditions, requirements and coverage.

Tricare Debt Protect is fully insured by licensed Canadian insurance companies.

Protects You From the Risk of Negative Equity

Negative equity occurs when the amount still owing on the finance contract is greater than the amount paid out by your insurance company in the event of a total loss. This difference is often referred to as the “GAP.”

A vehicle can be declared a total loss when:

- The cost to repair it exceeds the assessed value of the vehicle

- The vehicle is so damaged that repairing it is deemed unsafe

- The vehicle is stolen and not recovered

In the unfortunate event your vehicle is deemed a total loss, Tricare Loss Protect saves you from incurring large out-of-pocket expenses by covering the “GAP” between what your insurance company pays and the balance you may owe on your finance contract.

Covers the Void Left by Your Primary Vehicle Insurance Company

Tricare Loss Protect provides the top-up coverage to your insurer’s total loss payout and offers affordable peace of mind to deal with life’s unexpected challenges.

- Up to $50,000Includes any refinanced amount from a previous finance contract up to the maximum policy limit.

- $500 loyalty creditGood towards the price of a replacement vehicle when purchased from the original selling dealer or any other dealership within that dealer’s ownership group.

- Up to $1,000 creditTo cover insurance deductible in the event of a total loss.

Purchasing a vehicle is an exciting time. You’ve budgeted and saved wisely for your new investment, and now it’s time to make another important decision that will protect your financial obligation. Whether you are financing or leasing your vehicle, there are several options available to help protect your good credit and your family.

Credit Life Insurance

- Pays off the balance of your vehicle loan obligation in the event of death.

- Leaves your estate with the asset of the vehicle vs. the liability of the debt.

- Maintains the value of all your other insurance policies.

- It’s Affordable Peace of Mind.

Sickness & Injury

- Makes your vehicle loan payment for you if you are unable to work at your job.

- Confinement to your home or hospitalization not necessary.

- Benefits will continue until you can return to your job.

- Pays in addition to any workplace or private plans.

Critical Illness

- Pays off the balance of your vehicle loan in the event of: heart attack, stroke, malignant cancer, paralysis, organ transplant or bypass surgery.

- Most people survive their Critical Illness. With your vehicle loan paid off, any additional insurance benefits can be directed to where you need it most.

Please see your Certificate of Insurance for the specific terms, conditions, limitations and exclusions that apply to your coverage.