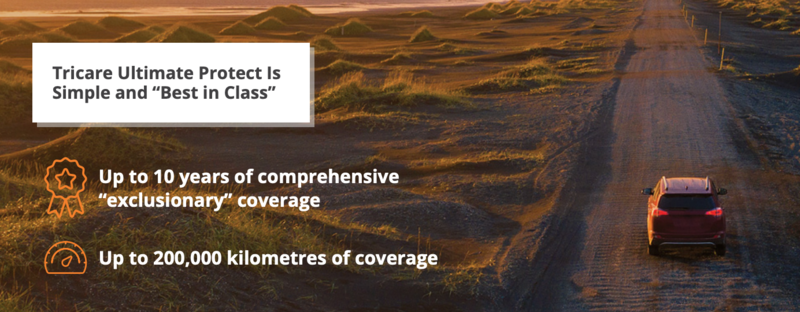

Protects you from the rising cost of mechanical and electronic repairs to your vehicle. Tricare Ultimate Protect ensures worry-free ownership for years and kilometres to come and shields you from the cost of unexpected repairs beyond the manufacturer’s original warranty. Added benefits include roadside assistance, substitute transportation allowance and a fast, efficient claims process.

Protection From Unexpected Repairs

It’s comforting to know that having this coverage will protect you from inflation and the ever-rising cost of mechanical or electronic repairs. Tricare Ultimate Protect allows you to enjoy your vehicle worry-free for years and kilometres to come. The average Canadian driver will own their car well beyond the expiry of the manufacturer’s limited warranty coverage. Today’s vehicles are loaded with sophisticated mechanical, electronic and computer systems. When any of these systems fail, the cost of repairs is always unexpected and most people do not budget for these large expenses.

Emergency Roadside Assistance Services Include:

Towing, Jump-Starts, Lockouts, Flat Tire Changes, Fluid Delivery Assistance and Concierge Service. Our highly trained team is at your disposal 24/7, 365 days a year.

- Towing - Towing services will be provided to you as part of our Emergency Roadside Assistance Program. We will pay up to $250 to tow your vehicle back to your selling dealership.

- Trip Interruption Coverage - In the event of a breakdown occurring over 160 kilometres from home, and covered by the contract, we will reimburse you for up to $125 per day toward food and lodging if the vehicle must remain overnight in the repair facility, up to a maximum of 3 days.

- Transportation Allowance - We will reimburse you up to $40 per day for almost any kind of substitute transportation from the date of the covered breakdown to the date the repair is completed.

- Immediate Credit Card Payment - We make a credit card payment to the repair facility less any deductible for the covered repairs so that you are not out of pocket and there is no waiting period for reimbursement.

- Easily Transferable - If the vehicle is sold privately during the term of the contract, the remaining Tricare Ultimate Protect coverage may be transferred to the new owner.

- Customer Loyalty Program - At trade-in time, you may be eligible to redeem the unused portion of your policy and apply it towards the purchase of a new Tricare contract on your next vehicle.

- North America—Wide Service - All Tricare plans are covered across Canada and the continental United States.

Purchasing a vehicle is an exciting time. You’ve budgeted and saved wisely for your new investment, and now it’s time to make another important decision that will protect your financial obligation. Whether you are financing or leasing your vehicle, there are several options available to help protect your good credit and your family.

Credit Life Insurance

- Pays off the balance of your vehicle loan obligation in the event of death.

- Leaves your estate with the asset of the vehicle vs. the liability of the debt.

- Maintains the value of all your other insurance policies.

- It’s Affordable Peace of Mind.

Sickness & Injury

- Makes your vehicle loan payment for you if you are unable to work at your job.

- Confinement to your home or hospitalization not necessary.

- Benefits will continue until you can return to your job.

- Pays in addition to any workplace or private plans.

Critical Illness

- Pays off the balance of your vehicle loan in the event of: heart attack, stroke, malignant cancer, paralysis, organ transplant or bypass surgery.

- Most people survive their Critical Illness. With your vehicle loan paid off, any additional insurance benefits can be directed to where you need it most.

Please see your Certificate of Insurance for the specific terms, conditions, limitations and exclusions that apply to your coverage.

What Is the Best Way to Pay for a Vehicle?

It is very likely that financing will be required when purchasing a vehicle, as few people have the ready cash available to pay for their new car or truck. Buying a new or used vehicle is one of the largest and most significant financial decisions you will make, therefore it is important to choose the right financing option to best suit your personal needs.

Learn more here and on the tabs to the right about your various payment options.

There are two main types of vehicle financing: Purchase and Lease financing. Either choice will likely have a cost attached because of associated interest charges. However, taking advantage of low-interest vehicle financing incentives available from the manufacturer allows the flexibility to use your money more productively.

The Application and Approval Process

The application and approval process is the same for both Personal and Auto loans and leases:The lender requires a complete credit application to support the credit request, along with other documents such as proof of income.In the case of a Personal loan, if the request is approved, funds can be quickly transferred to your account.

Amount to Finance

The amount that the financial institution will approve will determine the cost of vehicle that can be purchased or leased. Approval depends on a number of factors including the applicant’s:

- Income

- Credit history

- Credit score

- Current debt load

- Amount of money as a down payment

Financial institutions usually decline financing because the credit rating of the applicant is not strong enough. Many dealerships have financing experts who specialize in obtaining credit for buyers with weak or nonexistent credit, or with credit challenges.

The majority of vehicles purchased in Canada are financed with loans. The total cost of the vehicle is financed over the term of the loan, at which time the buyer owns the vehicle after the last payment is made.

Personal Versus Vehicle Loan

The most common method of purchasing a vehicle is by borrowing the money and repaying it in set monthly installments. This can be done either by taking out a Personal loan or a Vehicle loan. Most Personal loans are unsecured, meaning there is no collateral for the money being borrowing and the funds can be used for any purpose.

A Vehicle loan differs from a Personal loan because the money can only be used to purchase a vehicle. A secured loan means the vehicle serves as collateral against the loan. With security backing the loan application, there is usually a higher chance of approval and lower interest rates compared with an unsecured personal loan.

The Benefits of a Vehicle Loan

- Lower interest rates (compared to an unsecured personal loan) with terms up to 84 months or longer

- Reduced interest rates offered as manufacturer incentives for both New and Certified Pre-owned vehicles

- Fixed interest rates and will not vary during the term of the loan

- Open loans and can be paid off at any time without penalty

In Canada, leasing accounts for nearly a third of new vehicle sales. Pre-owned vehicles may be eligible for leasing as well. In a lease, the amount financed is based upon the initial cost of the vehicle and the Residual Value (RV). The RV is the amount the vehicle will be worth at the end of the term of the lease, based on an estimate of the lessor (the owner).

Types of Leases

When considering leasing a vehicle, it is important to determine what type of lease is most appropriate. There are two main types of leases: closed-end and open-end.

Closed-end Lease In a closed-end lease, the lessor of the vehicle is responsible for the RV of the vehicle, and the lessee has the option of either returning the vehicle at the end of the lease or buying it back from the lessor at the RV specified in the lease contract. New vehicle manufacturer leases are closed-end. At the end of the lease, if the option to buy the vehicle at the specified RV is not exercised, the lessee is responsible for paying for any damages that go beyond normal wear and tear and/or excess mileage charges that cause the vehicle to be worth less than the specified RV. Most closed-end leases also have a maximum mileage limit for the term, usually based upon annual mileage of between 16,000–24,000 kilometres. If this limit is exceeded, a specified per kilometre overage fee is charged at the end of the lease term.

Open-end Lease An open-end lease allows the lessee to guarantee the value of the vehicle at the end of the lease. This is called the Guaranteed Residual Value (GRV) and is specified in the lease contract. The lessee has the option of purchasing, selling or trading in the leased vehicle at the end of the contract for the GRV, provided the vehicle is worth at least that amount. If the market value of the vehicle is less than the GRV at the end of the lease, the lessee is responsible for the difference if they wish to return it to the lessor. For example, if the GRV is $16,000 and the market value for the vehicle is only $14,000 at the end of the contract, the lessee will be responsible for paying the difference of $2,000. Open-end leases are more common in business and commercial leasing. The person or company leasing the vehicle takes on the RV risk, and leasing terms may be more flexible.

The Benefits of Leasing

- New vehicle ownership every 2 to 4 years

- Shorter-team leases mean vehicle often still covered by OEM warranty

- Drive a more expensive model than anticipated

- Closed-end leases can protect you from risk of negative equity at lease end

The Benefits of Financing Through a Dealership

- Convenient, "on the spot" finance solution and expert advice

- Dealership finance specialists can negotiate the best terms and conditions on your behalf

- Access to Incentivized Finance Rates from the manufacturer

- Access to most or all of the major banks and other lenders

- Access to lenders that specialize in assisting credit-challenged buyers

- Fast approval and funding

Cash from Lines of Credit

Industry statistics show the majority of vehicles sold are financed by a loan or a lease. Bank studies indicate only a very small percentage of vehicle purchasers are true cash buyers. This is not surprising as Statistics Canada reports that the cash savings for the average Canadian family in 2018 was only $852.

However, there are 5 good reasons not to use a LOC to finance a vehicle:

- Although there are many types of LOCs, most are are secured by home equity LOC (HELOC).

- The LOC is a demand note, i.e., the financial institution can demand repayment of the full amount owing at any time.

- The interest rates are variable and can be raised at any time by the financial institution.

- The financial institution can raise or lower the credit limit on an HELOC.

- LOCs are designed as an interest-only loan.

The last point is very important. Financial institutions are in the business of lending money and collecting interest on those loans. An LOC is a revolving form of credit usually allowing interest-only payments to be made on the outstanding balance. Unfortunately, if a set monthly payment towards the outstanding balance is not made, it is possible that the loan will never be paid off, resulting in higher overall interest charges than a conventional loan, despite the lower interest rate of the LOC.

An IPSOS study of Canadian consumers conducted in 2018 revealed that 25 percent of respondents said they only made the interest payments month to month and that most consumers do not repay their HELOC in full until they sell their home. Financing with an LOC may result in a balance still owing when it comes time to sell or trade the vehicle.

In short, using an LOC to purchase a vehicle is not a wise financial decision.

Cash from Savings Instruments

Guaranteed Investment Certificates (GIC), Tax Free Saving Account (TFSA), Registered Retirement Savings Plans (RRSP).

Withdrawing money from a GIC, a TFSA, or an RRSP also allows the cash purchase of a new vehicle. Unfortunately, withdrawing those savings could result in negative tax consequences, i.e., paying income tax on the amount withdrawn. In most cases, leaving money invested is a wiser financial move as it continues to earn interest and appreciate as originally intended.