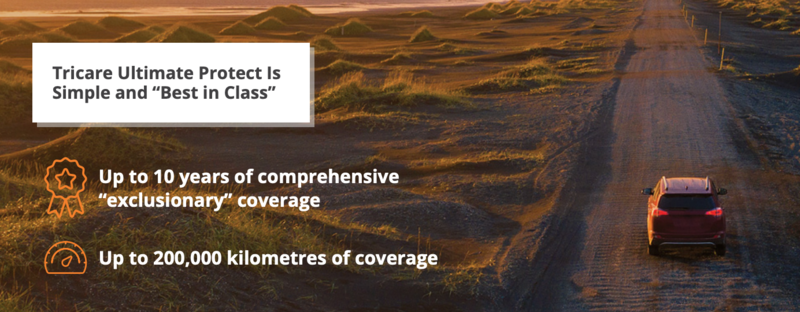

Protects you from the rising cost of mechanical and electronic repairs to your vehicle. Tricare Ultimate Protect ensures worry-free ownership for years and kilometres to come and shields you from the cost of unexpected repairs beyond the manufacturer’s original warranty. Added benefits include roadside assistance, substitute transportation allowance and a fast, efficient claims process.

Protection From Unexpected Repairs

It’s comforting to know that having this coverage will protect you from inflation and the ever-rising cost of mechanical or electronic repairs. Tricare Ultimate Protect allows you to enjoy your vehicle worry-free for years and kilometres to come. The average Canadian driver will own their car well beyond the expiry of the manufacturer’s limited warranty coverage. Today’s vehicles are loaded with sophisticated mechanical, electronic and computer systems. When any of these systems fail, the cost of repairs is always unexpected and most people do not budget for these large expenses.

Emergency Roadside Assistance Services Include:

Towing, Jump-Starts, Lockouts, Flat Tire Changes, Fluid Delivery Assistance and Concierge Service. Our highly trained team is at your disposal 24/7, 365 days a year.

- Towing - Towing services will be provided to you as part of our Emergency Roadside Assistance Program. We will pay up to $250 to tow your vehicle back to your selling dealership.

- Trip Interruption Coverage - In the event of a breakdown occurring over 160 kilometres from home, and covered by the contract, we will reimburse you for up to $125 per day toward food and lodging if the vehicle must remain overnight in the repair facility, up to a maximum of 3 days.

- Transportation Allowance - We will reimburse you up to $40 per day for almost any kind of substitute transportation from the date of the covered breakdown to the date the repair is completed.

- Immediate Credit Card Payment - We make a credit card payment to the repair facility less any deductible for the covered repairs so that you are not out of pocket and there is no waiting period for reimbursement.

- Easily Transferable - If the vehicle is sold privately during the term of the contract, the remaining Tricare Ultimate Protect coverage may be transferred to the new owner.

- Customer Loyalty Program - At trade-in time, you may be eligible to redeem the unused portion of your policy and apply it towards the purchase of a new Tricare contract on your next vehicle.

- North America—Wide Service - All Tricare plans are covered across Canada and the continental United States.

Purchasing a vehicle is an exciting time. You’ve budgeted and saved wisely for your new investment, and now it’s time to make another important decision that will protect your financial obligation. Whether you are financing or leasing your vehicle, there are several options available to help protect your good credit and your family.

Credit Life Insurance

- Pays off the balance of your vehicle loan obligation in the event of death.

- Leaves your estate with the asset of the vehicle vs. the liability of the debt.

- Maintains the value of all your other insurance policies.

- It’s Affordable Peace of Mind.

Sickness & Injury

- Makes your vehicle loan payment for you if you are unable to work at your job.

- Confinement to your home or hospitalization not necessary.

- Benefits will continue until you can return to your job.

- Pays in addition to any workplace or private plans.

Critical Illness

- Pays off the balance of your vehicle loan in the event of: heart attack, stroke, malignant cancer, paralysis, organ transplant or bypass surgery.

- Most people survive their Critical Illness. With your vehicle loan paid off, any additional insurance benefits can be directed to where you need it most.

Please see your Certificate of Insurance for the specific terms, conditions, limitations and exclusions that apply to your coverage.

Protects You From the Risk of Negative Equity

Negative equity occurs when the amount still owing on the finance contract is greater than the amount paid out by your insurance company in the event of a total loss. This difference is often referred to as the “GAP.”

A vehicle can be declared a total loss when:

- The cost to repair it exceeds the assessed value of the vehicle

- The vehicle is so damaged that repairing it is deemed unsafe

- The vehicle is stolen and not recovered

In the unfortunate event your vehicle is deemed a total loss, Tricare Loss Protect saves you from incurring large out-of-pocket expenses by covering the “GAP” between what your insurance company pays and the balance you may owe on your finance contract.

Covers the Void Left by Your Primary Vehicle Insurance Company

Tricare Loss Protect provides the top-up coverage to your insurer’s total loss payout and offers affordable peace of mind to deal with life’s unexpected challenges.

- Up to $50,000Includes any refinanced amount from a previous finance contract up to the maximum policy limit.

- $500 loyalty creditGood towards the price of a replacement vehicle when purchased from the original selling dealer or any other dealership within that dealer’s ownership group.

- Up to $1,000 creditTo cover insurance deductible in the event of a total loss.